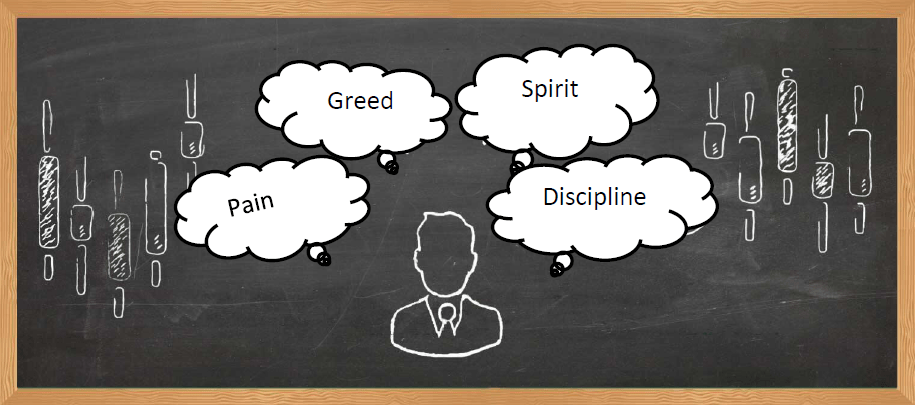

Psychology plays a vital role in determining success and/or failure of the traders. In trading career, it almost plays an eighty (80) percent role and other twenty (20) percent is determined on the basis of one’s analysis. Even with clear trading strategies to analyze the market, vast majority of traders faces loses since they indulge into emotional trading or their inability to control them.

- What is the motivation for trading?

- How one’s emotions affect the decision making process?

- How to avoid the failures and become a successful trader?

- How to learn from past trading mistakes?

Have you ever wondered about these questions ?

Accepting and sticking to certain rules which shall help one in determing one’s priorities and eventually be successful in trading. These could be –

- Rule 1: Be objective – it is impossible to win million in a minute.

In stock trading, decisive influence on the behavior of the trader is impacted by numerous emotions such as fear, greed, hope, etc. Weak, over-confident, greedy and slow; all these are doomed to become the victims of the market sooner or later. The recognition of one’s own abilities whether being positive or negative, shall help an individual as a trader in avoiding failures. If one would add the ability of adequate evaluation of the psychological state and the behavior of the market to the above mentioned, the success is assured.

“The market will teach you many lessons before you consistently make money. The most dangerous thing you can do is make a lot of money at the beginning. That usually leads to recklessness and big losses in the long run. New Traders make the wrong decisions because of stress; Rich Traders can manage stress.” – NEW TRADER RICH TRADER

Objective traders have a quantified method, system, rules, and principles that they use to trade. They get into trading based on facts, and where they get out is based on price action. Objective traders have a written trading plan to guide them. They use objective historical price action, charts, probabilities, risk management, and edge. They react to what is happening only if it could be quantified. They go with the flow of price action, and are not guided by their emotions. One must not attach ego to trade. One must be the trader that witnesses trade from an emotional distance, with respect and curiosity. If one can put space between oneself and trade, one shall become more accurate and more profitable.

- Rule 2: Do not be too greedy.

One of the driving forces that makes one to take part in the work of speculative financial markets is the possibility of earning “easy money” or, in another way ‘greed’. The result of this action is usually the motivation for taking trades.

“People who look for easy money invariably pay for the privilege of proving conclusively that it cannot be found on this earth.” -JESSE LIVERMORE

One can distinguish between two kinds of motivations:

- Rational motivation is expressed through cold prudence when taking decisions about taking a trade;

- Irrational motivation is expressed through passion of the player; the others are the slaves of their emotions and are practically doomed to loose.

If the trader does not have a working plan formed before taking trade, it would mean that the person is likely to work under the influence of greed without being backed by strong reasoning. New traders are often impatient and look for constant action while professional traders are patient and usually wait for entry- exit signals.

“Realistically, a good trader can get a 10% to 25% return or more per year. Some great years can produce 50% returns or more, but those are rare. It’s more likely that a trader will lose money the first year, but gain an education. You should look at it like paying tuition. Trading is a profession like any other, and you’re trading against professionals most of the time. A surgeon doesn’t just read a book and start practicing medicine. They must go to medical school to learn the proper procedures from other doctors. And they will have to practice and make mistakes before they are a paid professional. With surgeons, hopefully their mistakes are made in medical school and not on the operating table!”

– NEW TRADER RICH TRADER

- Rule 3: Do not over-rate your abilities – stick to the calculations.

The motivating factor for the trader to trade is the hope to generate profits. If the hope prevails over the profit calculations, the trader undertakes the risk of overestimating his abilities while analyzing the situation. Hope must be placed in subordinate relations, both with the calculation and the greed. It is high hopes that nears the beginners to failure. The trader living on hope is doomed to fail. It is hope that drives traders towards making one of the most cruel mistakes – shift of the stop-loss order level.

- Rule 4: Accept failure.

One shall not be able to become a successful trader until one is ready for both, the profits and the losses. It is difficult to sit in a winning trade till target, but to become a successful trader one has to sit till either stop loss or target. Both of them are important and inseparable parts of the trading process. On the way of mastering the art of trade, the barriers are very often met. When the trader focuses on the problems (there can be numerous problems, for instance, lack of means, resources and knowledge), he feels angry, guilty, disappointmented and dissatisfied. These rising tide of emotions shall not let him move ahead. If the loss is unacceptable for the trader, he shall not be able to close the losing position. When the trader is not ready to face losses, they usually become larger.

- Rule 5: Preapre Trade Journal

Trade Journal is a diary in which one writes about the deals that one makes. One needs to mention details like reasons for taking trade, the thoughts pouring in while trading, reasons behind stop losses and targets, reasons of taking exit from the trade. These all details must be there for every trade one initiates. The following task is to review one’s journal on a daily basis and on weekends to review the week’s trading history. The daily journaling shall help one to learn from mistakes and shall help an individual in avoiding those mistakes and aid in controlling the surge of emotions while treading.

“If you experience high levels of stress during trading, either your position size is too large or you don’t have enough confidence in your system. To reduce stress, lower your positions or do more testing on your system.” -STEVE BURNS

Even the world famous trader Umar Ashraf maintains trade journal for his trades, and this is the major reason behind his successful trading career.

- Trading Philosophy

One must not confuse confidence with extreme self-confidence. In trading, there is a tiny minority of winners and overwhelming majority of losers and the latter wishes to know the secrets of success of the winners. But is there a difference between them? Yes, there is! The one who makes money over weeks, months and years, trade by keeping self-discipline. To the question of the secret of stable market triumph, the winner answers without hesitation, that one attained such heights by learning how to control emotions and change decisions to match the market.

Extreme confidence easily transforms into a dangerous quality, as people who are over confident in their beliefs do not pay attention to important information which is valuable for trading decisions. Confidence and negative emotions are directly related to each other in strength. In general, confidence and fear are similar senses by nature; while one is with a “plus” sign, the other is with a “negative” sign. If the person is confident, there is a little room left for confusion, alarm and fear.

How does self-confidence develop?

In a natural way, an individual gets used to relying on oneself in everything that one does without any hesitation. With such trust one does not have to fear the market with its seemingly unpredictable and chaotic behavior. The matter here is not with one at all, as the market did not change but the inner world and psychological warehouse of the trader have.

Rich Trader’s Tip:

Trading stress is typically caused by one of two things: either not knowing what to do, or knowing what to do and being too afraid to do it. Only risk 1% of your total trading capital per trade by using stop losses and proper position sizing. Proper position sizing limits the emotional impact of a single trade. Each trade is only one of the next one hundred. If you keep this in mind, it will give you a completely different trading perspective. And remember, if you don’t know what to do, don’t do anything!

– STEVE BURNS